As the world of cryptocurrency continues to grow and evolve, more and more investors are looking to add digital assets to their portfolios. With over 5,000 different cryptocurrencies to choose from, selecting the right one can be a daunting task. In this article, we will provide a comprehensive guide on how to choose the right cryptocurrency for your portfolio, including factors to consider, types of cryptocurrencies, and a step-by-step approach to making an informed decision.

Understanding Your Investment Goals and Risk Tolerance

Before selecting a cryptocurrency, it’s essential to understand your investment goals and risk tolerance. Are you looking for long-term growth or short-term gains? Are you willing to take on high levels of risk or do you prefer more conservative investments? Your investment goals and risk tolerance will help guide your decision-making process and ensure that you choose a cryptocurrency that aligns with your overall investment strategy.

Factors to Consider

When evaluating a cryptocurrency, there are several factors to consider. These include:

- Market Capitalization: The total value of all outstanding coins or tokens. A higher market capitalization generally indicates a more stable and established cryptocurrency.

- Liquidity: The ability to buy or sell a cryptocurrency quickly and at a stable price. A high level of liquidity is essential for minimizing losses and maximizing gains.

- Volatility: The degree of price fluctuations. Cryptocurrencies with high volatility can be more profitable, but they also come with a higher level of risk.

- Use Case: The real-world application of the cryptocurrency. Does it have a clear use case, or is it simply a speculative investment?

- Development Team: The team behind the cryptocurrency. Are they experienced, transparent, and committed to the project’s success?

- Security: The measures in place to protect the cryptocurrency from hacking and other security threats.

- Scalability: The ability of the cryptocurrency to handle increased demand and growth.

- Regulation: The level of regulatory oversight and compliance. Some cryptocurrencies may be subject to stricter regulations, which can impact their adoption and growth.

Types of Cryptocurrencies

There are several types of cryptocurrencies, each with its unique characteristics and use cases. These include:

- Payment Cryptocurrencies: Designed for everyday transactions, such as Bitcoin and Litecoin.

- Smart Contract Cryptocurrencies: Enable the creation and execution of self-enforcing contracts, such as Ethereum and Cardano.

- Stablecoins: Pegged to a traditional currency or asset, such as Tether and USDC.

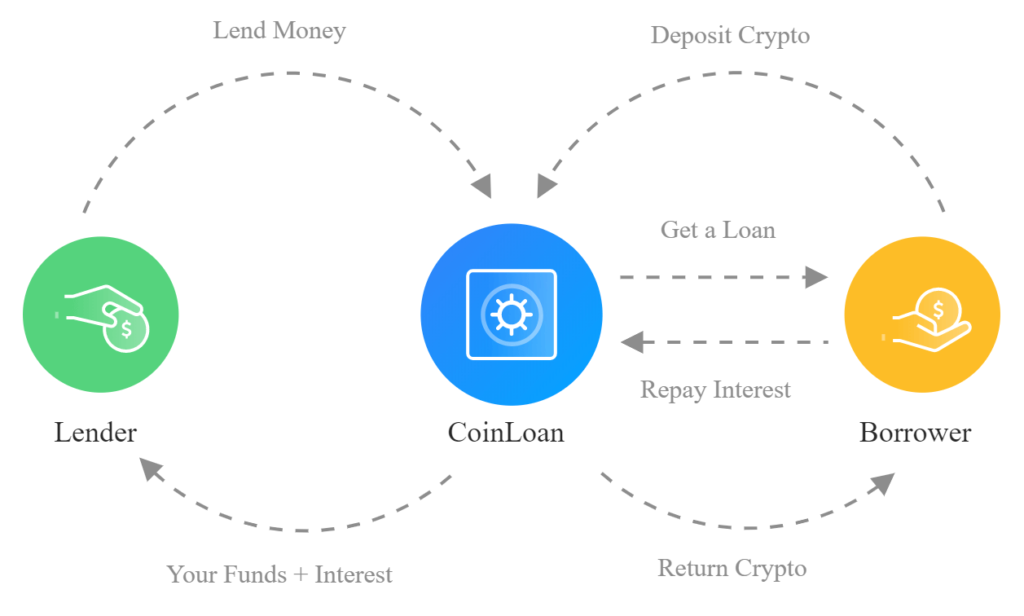

- DeFi Cryptocurrencies: Focus on decentralized finance applications, such as lending and borrowing, like Maker and Compound.

- Gaming Cryptocurrencies: Designed for online gaming and virtual worlds, such as Enjin and The Sandbox.

- Social Media Cryptocurrencies: Reward users for creating and engaging with content, such as Steem and LBRY.

Step-by-Step Approach to Choosing a Cryptocurrency

To choose the right cryptocurrency for your portfolio, follow these steps:

- Research and Education: Learn about the different types of cryptocurrencies, their use cases, and the factors that impact their value.

- Set Clear Investment Goals: Define your investment goals, risk tolerance, and time horizon.

- Evaluate Market Trends: Analyze current market trends, including price movements, trading volumes, and sentiment analysis.

- Assess the Development Team: Research the team behind the cryptocurrency, including their experience, track record, and commitment to the project.

- Review Security and Scalability: Examine the measures in place to protect the cryptocurrency from security threats and ensure its scalability.

- Consider Regulation and Compliance: Evaluate the level of regulatory oversight and compliance, including any potential risks or obstacles.

- Analyze Use Case and Adoption: Assess the real-world application and potential for adoption, including partnerships, collaborations, and user engagement.

- Diversify Your Portfolio: Spread your investment across multiple cryptocurrencies to minimize risk and maximize returns.

Top Cryptocurrencies to Consider

Based on market capitalization, liquidity, and adoption, some of the top cryptocurrencies to consider include:

- Bitcoin (BTC): The largest and most established cryptocurrency, with a strong brand and widespread adoption.

- Ethereum (ETH): The second-largest cryptocurrency, with a robust ecosystem of decentralized applications and smart contracts.

- Ripple (XRP): A fast and low-cost payment cryptocurrency, with a strong focus on cross-border transactions and partnerships with major banks.

- Litecoin (LTC): A lightweight and fast payment cryptocurrency, with a strong brand and growing adoption.

- Cardano (ADA): A smart contract cryptocurrency with a strong focus on security, scalability, and regulatory compliance.

Conclusion

Choosing the right cryptocurrency for your portfolio requires careful consideration of several factors, including market capitalization, liquidity, volatility, use case, development team, security, scalability, and regulation. By following a step-by-step approach and evaluating different types of cryptocurrencies, you can make an informed decision that aligns with your investment goals and risk tolerance. Remember to diversify your portfolio, stay up-to-date with market trends, and continually assess the cryptocurrencies in your portfolio to ensure they remain aligned with your investment strategy.

Additional Tips and Considerations

- Stay Informed: Continuously educate yourself on the latest developments, trends, and news in the cryptocurrency market.

- Use Reputable Exchanges: Only use reputable and well-established exchanges to buy, sell, and trade cryptocurrencies.

- Secure Your Assets: Use robust security measures, such as hardware wallets and two-factor authentication, to protect your cryptocurrencies from hacking and other security threats.

- Tax Implications: Understand the tax implications of buying, selling, and holding cryptocurrencies, and consult with a tax professional if necessary.

- Community Engagement: Engage with the cryptocurrency community, including online forums, social media, and meetups, to stay informed and network with other investors and enthusiasts.

By following these tips and considerations, you can navigate the complex and ever-changing world of cryptocurrency and make informed investment decisions that align with your goals and risk tolerance. Remember to always prioritize security, stay informed, and continually assess your portfolio to ensure long-term success in the cryptocurrency market.

Leave a Reply