The world of cryptocurrency has experienced tremendous growth over the past decade, with an increasing number of investors and traders diving into the market. While buying and holding cryptocurrencies can be a lucrative investment strategy, it can also be a passive one. For those looking to generate returns on their digital assets, crypto lending has emerged as a popular option. In this article, we will delve into the world of crypto lending, exploring how to earn interest on your coins, the benefits and risks involved, and the various platforms that offer lending services.

What is Crypto Lending?

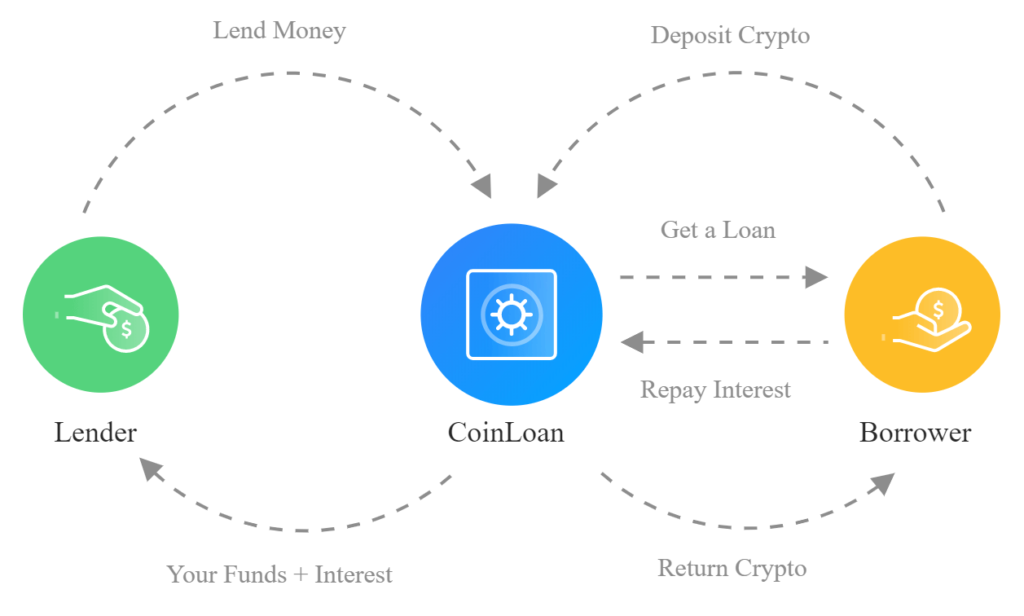

Crypto lending, also known as cryptocurrency lending or crypto loaning, refers to the process of lending your digital assets to others in exchange for interest payments. This concept is similar to traditional lending, where individuals lend their money to banks or other financial institutions to earn interest. In the crypto space, lending involves transferring your cryptocurrencies to a platform or individual, which then uses the assets to generate returns through various activities, such as margin trading, liquidity provision, or staking.

How Does Crypto Lending Work?

The process of crypto lending typically involves the following steps:

- Selecting a Lending Platform: You choose a reputable crypto lending platform that offers interest-bearing accounts or loan options.

- Depositing Your Coins: You deposit your cryptocurrencies into the platform’s wallet or account.

- Setting Lending Terms: You specify the terms of the loan, including the interest rate, loan duration, and collateral requirements (if applicable).

- Borrowing and Utilization: The platform or borrower uses your coins to generate returns, such as through margin trading or liquidity provision.

- Interest Payments: The borrower repays the loan with interest, which is then distributed to you as the lender.

Benefits of Crypto Lending

Crypto lending offers several benefits, including:

- Passive Income: By lending your cryptocurrencies, you can generate passive income in the form of interest payments.

- Diversified Portfolio: Lending can help diversify your investment portfolio, reducing reliance on a single asset or market.

- Low Barrier to Entry: Many crypto lending platforms have low minimum deposit requirements, making it accessible to a wide range of investors.

- Flexibility: Lending terms can be flexible, allowing you to choose the duration and interest rate that suits your investment goals.

- Security: Reputable lending platforms often offer robust security measures, such as multi-signature wallets and insurance coverage.

Risks Involved in Crypto Lending

While crypto lending can be a lucrative opportunity, it is essential to be aware of the potential risks involved:

- Default Risk: Borrowers may default on their loans, resulting in losses for the lender.

- Market Volatility: Market fluctuations can impact the value of the borrowed assets, potentially leading to losses.

- Platform Risk: Lending platforms may be vulnerable to hacks, scams, or mismanagement, which can compromise the security of your assets.

- Regulatory Risks: The regulatory environment for crypto lending is still evolving and may be subject to change, potentially impacting the legitimacy of lending platforms.

- Liquidity Risks: Lending platforms may experience liquidity issues, making it difficult to withdraw your assets or receive interest payments.

Popular Crypto Lending Platforms

Several reputable platforms offer crypto lending services, including:

- BlockFi: A well-established platform that offers interest-bearing accounts and loans for a range of cryptocurrencies.

- Celsius Network: A crypto lending platform that provides high-interest rates and a user-friendly interface.

- Nexo: A lending platform that offers instant credit lines and high-yield interest accounts.

- Compound: A decentralized lending protocol that allows users to lend and borrow cryptocurrencies.

- dYdX: A decentralized lending platform that offers margin trading and lending services.

Tips for Crypto Lending

To ensure a successful and secure crypto lending experience, follow these tips:

- Research and Due Diligence: Thoroughly research the lending platform, its reputation, and terms before depositing your assets.

- Set Realistic Expectations: Understand the potential returns and risks involved in crypto lending and set realistic expectations.

- Diversify Your Portfolio: Spread your investments across multiple lending platforms and assets to minimize risk.

- Monitor Market Conditions: Keep an eye on market fluctuations and adjust your lending strategy accordingly.

- Stay Informed: Stay up-to-date with the latest developments in the crypto lending space, including regulatory changes and platform updates.

Conclusion

Crypto lending offers a unique opportunity for investors to generate passive income on their digital assets. While it involves risks, the potential benefits make it an attractive option for those looking to diversify their investment portfolios. By selecting a reputable lending platform, understanding the terms and conditions, and being aware of the potential risks, you can successfully navigate the world of crypto lending. As the crypto space continues to evolve, it is likely that crypto lending will become an increasingly popular investment strategy, providing a new avenue for individuals to earn interest on their coins.

Future of Crypto Lending

The future of crypto lending is promising, with several developments on the horizon that are expected to shape the industry. These include:

- Increased Adoption: As more investors become aware of crypto lending, adoption is likely to increase, driving growth and innovation in the space.

- Regulatory Clarity: As regulatory frameworks become more defined, lending platforms will be able to operate with greater confidence, leading to increased security and stability.

- Improved Security: Advances in security measures, such as multi-signature wallets and insurance coverage, will help protect lenders’ assets.

- Decentralized Lending: The growth of decentralized lending protocols will provide greater transparency, security, and flexibility for lenders and borrowers.

- Integration with Traditional Finance: The integration of crypto lending with traditional finance will enable greater access to capital and more efficient lending processes.

As the crypto lending space continues to evolve, it is essential to stay informed and adapt to the changing landscape. By doing so, you can capitalize on the opportunities presented by crypto lending and earn interest on your coins in a secure and efficient manner.

Leave a Reply