The world of cryptocurrency trading has gained immense popularity in recent years, with more and more people looking to invest in digital assets such as Bitcoin, Ethereum, and other altcoins. However, for beginners, the process of getting started with crypto trading can seem daunting and overwhelming. In this article, we will provide a step-by-step guide on how to get started with crypto trading, covering the basics of cryptocurrency, the different types of trading, and the necessary tools and resources to help you succeed.

Introduction to Cryptocurrency

Before diving into the world of crypto trading, it’s essential to understand the basics of cryptocurrency. A cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it’s not controlled by any government or financial institution. The most well-known cryptocurrency is Bitcoin, but there are over 5,000 other cryptocurrencies available, each with its unique features and uses.

Types of Crypto Trading

There are several types of crypto trading, including:

- Day Trading: This involves buying and selling cryptocurrencies within a single trading day, with the goal of making a profit from the price fluctuations.

- Swing Trading: This involves holding onto a cryptocurrency for a shorter period, usually a few days or weeks, with the goal of making a profit from the price swings.

- Long-Term Investing: This involves holding onto a cryptocurrency for an extended period, usually months or years, with the goal of making a profit from the long-term growth of the asset.

- Margin Trading: This involves borrowing money from a broker to buy more cryptocurrencies, with the goal of making a profit from the price fluctuations.

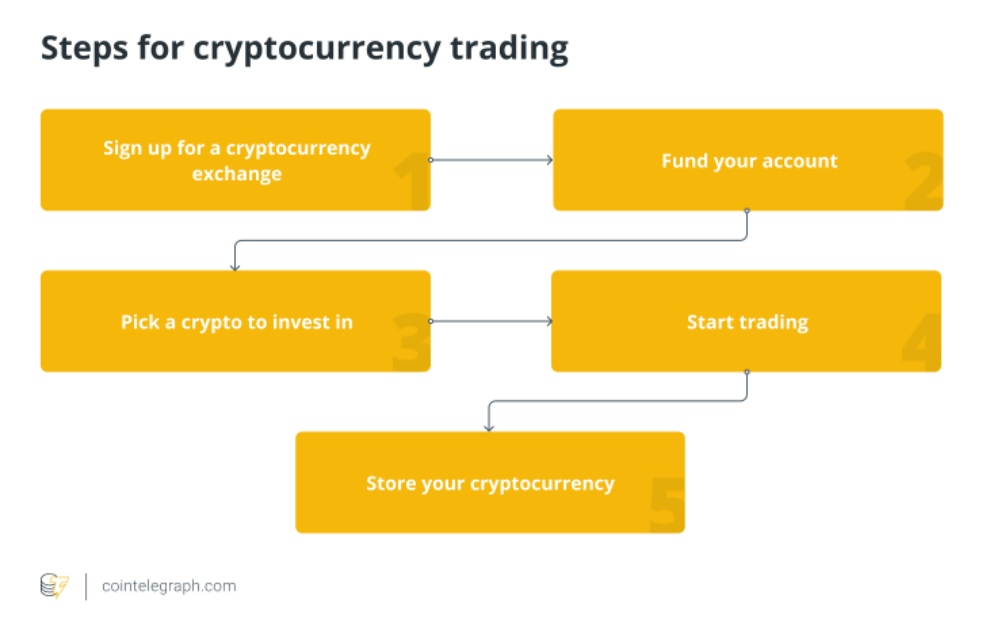

Step 1: Choose a Cryptocurrency Exchange

To get started with crypto trading, you’ll need to choose a reputable cryptocurrency exchange. A cryptocurrency exchange is a platform where you can buy, sell, and trade cryptocurrencies. Some popular cryptocurrency exchanges include:

- Binance: One of the largest and most popular cryptocurrency exchanges, offering a wide range of cryptocurrencies and trading pairs.

- Coinbase: A well-established and reputable exchange, offering a user-friendly interface and a limited selection of cryptocurrencies.

- Kraken: A professional-grade exchange, offering a wide range of cryptocurrencies and advanced trading features.

When choosing a cryptocurrency exchange, consider the following factors:

- Fees: Look for an exchange with low fees, as high fees can eat into your profits.

- Security: Choose an exchange with a strong reputation for security, as you’ll be storing your cryptocurrencies on the exchange.

- Liquidity: Look for an exchange with high liquidity, as this will make it easier to buy and sell cryptocurrencies.

- User Interface: Choose an exchange with a user-friendly interface, as this will make it easier to navigate and trade.

Step 2: Set Up Your Account

Once you’ve chosen a cryptocurrency exchange, you’ll need to set up your account. This typically involves:

- Creating an account: Provide your email address, password, and other basic information to create an account.

- Verifying your identity: Provide identification documents, such as a passport or driver’s license, to verify your identity.

- Setting up two-factor authentication: Add an extra layer of security to your account by setting up two-factor authentication.

Step 3: Fund Your Account

To start trading, you’ll need to fund your account with fiat currency (such as USD or EUR) or cryptocurrencies. You can do this by:

- Transferring funds from your bank account: Use a wire transfer or online banking to transfer funds from your bank account to your exchange account.

- Using a credit or debit card: Use a credit or debit card to buy cryptocurrencies directly from the exchange.

- Transferring cryptocurrencies from another exchange: Transfer cryptocurrencies from another exchange to your new exchange account.

Step 4: Choose Your Trading Strategy

Before you start trading, it’s essential to choose a trading strategy that suits your goals and risk tolerance. Consider the following:

- Technical analysis: Use technical indicators and charts to analyze the market and make trading decisions.

- Fundamental analysis: Analyze the underlying fundamentals of a cryptocurrency, such as its technology, team, and market demand.

- News-based trading: React to news and events that may impact the price of a cryptocurrency.

Step 5: Start Trading

Once you’ve set up your account, funded it, and chosen your trading strategy, you can start trading. Here are a few things to keep in mind:

- Start small: Begin with a small amount of money and gradually increase your investment as you gain experience.

- Use stop-loss orders: Set stop-loss orders to limit your losses if the market moves against you.

- Monitor your trades: Keep an eye on your trades and adjust your strategy as needed.

Additional Tools and Resources

To help you succeed in crypto trading, consider the following tools and resources:

- Trading platforms: Use a trading platform, such as MetaTrader or TradingView, to analyze the market and execute trades.

- Technical indicators: Use technical indicators, such as moving averages or RSI, to analyze the market and make trading decisions.

- News and market data: Stay up-to-date with the latest news and market data to stay ahead of the curve.

- Communities and forums: Join online communities and forums to connect with other traders and learn from their experiences.

Conclusion

Getting started with crypto trading can seem overwhelming, but by following these steps, you can set yourself up for success. Remember to choose a reputable exchange, set up your account, fund it, and choose your trading strategy. Start small, use stop-loss orders, and monitor your trades to minimize your losses. With the right tools and resources, you can navigate the world of crypto trading and make informed decisions to achieve your financial goals.

Final Tips

- Stay informed: Stay up-to-date with the latest news and market data to stay ahead of the curve.

- Be patient: Crypto trading can be volatile, so be patient and don’t make impulsive decisions.

- Diversify your portfolio: Spread your investment across multiple cryptocurrencies to minimize your risk.

- Learn from your mistakes: Analyze your mistakes and learn from them to improve your trading strategy.

By following these steps and tips, you can get started with crypto trading and begin your journey to financial success. Remember to always do your own research, stay informed, and never invest more than you can afford to lose. Happy trading!

Leave a Reply