The world of cryptocurrency has grown exponentially over the past few years, with the industry now valued at over $2 trillion. However, as the industry continues to evolve, regulatory frameworks have become a pressing concern for investors, policymakers, and businesses alike. The United States and Europe are two of the largest markets for cryptocurrencies, but they have distinct approaches to regulating the industry. In this article, we will explore the differences and similarities between crypto regulation in the US and Europe, helping investors make informed decisions in this rapidly evolving space.

United States: A Patchwork of Regulations

In the US, crypto regulation is a patchwork of state and federal laws, with various agencies playing a role in overseeing different aspects of the industry. The main regulatory bodies are:

- Securities and Exchange Commission (SEC): Responsible for regulating securities, including initial coin offerings (ICOs) and digital assets deemed to be securities.

- Commodity Futures Trading Commission (CFTC): Oversees the trading of crypto derivatives and futures contracts.

- Financial Crimes Enforcement Network (FinCEN): Enforces anti-money laundering (AML) and know-your-customer (KYC) regulations for virtual currency exchanges and related businesses.

- Internal Revenue Service (IRS): Taxes cryptocurrency transactions and investments.

The US has a complex regulatory landscape, and states have taken varying approaches to crypto regulation. Some states, such as Wyoming and Arizona, have created friendly environments for crypto businesses, while others, like New York, have stringent regulations.

Europe: A Uniform Regulatory Framework

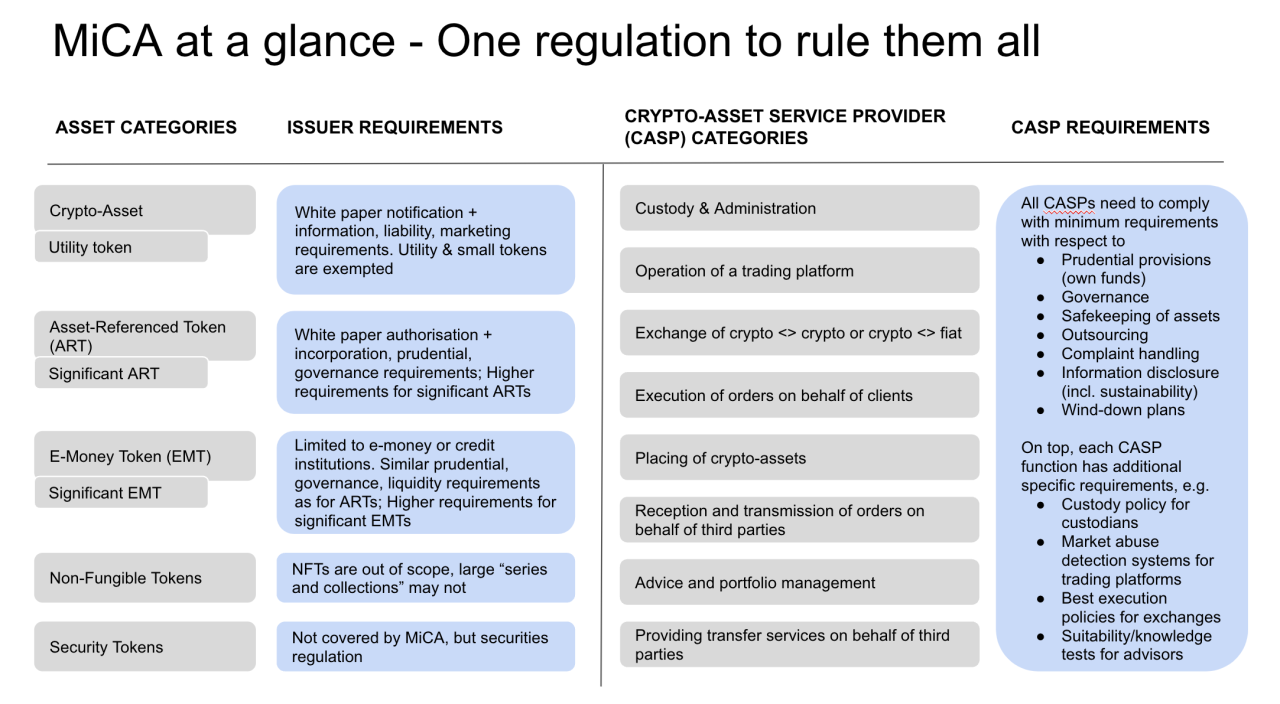

In contrast to the US, the European Union (EU) has established a uniform regulatory framework for cryptocurrencies through the Markets in Crypto-Assets (MiCA) regulation. MiCA, which was adopted in 2022, provides a comprehensive set of rules for the crypto industry, covering areas such as:

- Initial Coin Offerings: Standardizes the requirements for ICOs, including whitepaper requirements and marketing restrictions.

- Crypto-Asset Service Providers: Regulates businesses offering services related to cryptocurrencies, including exchanges, wallets, and custodial services.

- Stablecoins: Separately regulates stablecoins, which are digital assets pegged to a fiat currency or other stable asset.

The EU’s approach to crypto regulation emphasizes transparency, security, and consumer protection. MiCA provides a single set of rules applicable across all EU member states, reducing regulatory uncertainty and creating a more harmonized market.

Key Differences in US and EU Crypto Regulation

While both the US and EU have taken steps to regulate the crypto industry, there are significant differences in their approaches. Some key differences include:

- Jurisdictional scope: The EU’s MiCA regulation applies uniformly across all member states, while the US has a patchwork of state and federal laws.

- Security status: The SEC has taken a relatively strict stance on the security status of cryptocurrencies, deeming most digital assets to be securities. In contrast, the EU’s MiCA regime distinguishes between security tokens and non-security tokens.

- Exemptions: The US has more carve-outs for decentralized finance (DeFi) and other non-traditional business models, while the EU’s MiCA has more stringent requirements for intermediaries.

Impact on Investors

The differences in regulatory approaches between the US and EU can impact investors in several ways:

- Market access: The EU’s MiCA regulation provides a more straightforward path for crypto businesses to access the European market, while the US has more complex and variable requirements.

- Taxation: The US has more variable tax requirements, depending on the type of investment and its location. In contrast, the EU has a more harmonized tax framework for cryptocurrencies.

- Compliance costs: The EU’s MiCA regime requires more robust compliance measures, including more stringent KYC/AML requirements. This may increase costs for businesses operating in the EU.

Best Practices for Investors

In this rapidly evolving and complex regulatory landscape, investors should consider the following best practices:

- Diversification: Spread investments across different asset classes and geographic regions to minimize regulatory risk.

- Research: Stay up to date with regulatory changes and developments in the US and EU.

- Compliance: Ensure that investments are made through reputable exchanges and wallet providers that comply with local regulations.

- Tax planning: Consult with tax professionals to ensure compliance with tax requirements and minimize tax liabilities.

Conclusion

The US and EU have different approaches to regulating the crypto industry, reflecting their unique market conditions and regulatory priorities. As the industry continues to evolve, it is essential for investors to stay informed about regulatory developments and adjust their strategies accordingly. By understanding the differences and similarities between US and EU crypto regulation, investors can navigate this complex landscape and make informed decisions about their investments.

FAQs

- What is the US regulatory framework for cryptocurrencies?

The US has a patchwork of state and federal laws regulating different aspects of the crypto industry, including the SEC, CFTC, FinCEN, and IRS.

- What is the EU’s MiCA regulation?

MiCA is a comprehensive set of rules regulating the crypto industry in the EU, covering ICOs, crypto-asset service providers, stablecoins, and other aspects of the industry.

- How does the US regulatory framework impact investors?

The US regulatory framework can impact investors through variable tax requirements, market access restrictions, and compliance costs.

- What are some best practices for investors in the crypto industry?

Investors should diversify their investments, stay informed about regulatory changes, ensure compliance with local regulations, and consult with tax professionals.

In conclusion, as the crypto industry continues to grow and mature, regulatory frameworks will play a crucial role in shaping the market. By understanding the differences and similarities between US and EU crypto regulation, investors can navigate this complex landscape and make informed decisions about their investments.

Leave a Reply