The world of cryptocurrency is constantly evolving, with new developments and events shaping the market every day. One of the most significant events in the Bitcoin calendar is the halving, which occurs approximately every four years. In this article, we will delve into the concept of Bitcoin halving, its history, and what it means for investors.

What is Bitcoin Halving?

Bitcoin halving, also known as the "halvening," is a predetermined event that occurs in the Bitcoin network. It is designed to reduce the block reward, which is the number of new Bitcoins that are released into circulation with each block of transactions. The block reward is cut in half, hence the term "halving." This reduction in block reward is intended to limit the supply of new Bitcoins, thereby slowing down the rate at which new coins are added to the network.

The halving is programmed to occur every 210,000 blocks, or approximately every four years. The event is a significant milestone in the Bitcoin network, as it has a direct impact on the number of new coins that are being created and added to the network. The halving is written into the Bitcoin protocol, which means that it is an immutable and predictable aspect of the network.

History of Bitcoin Halving

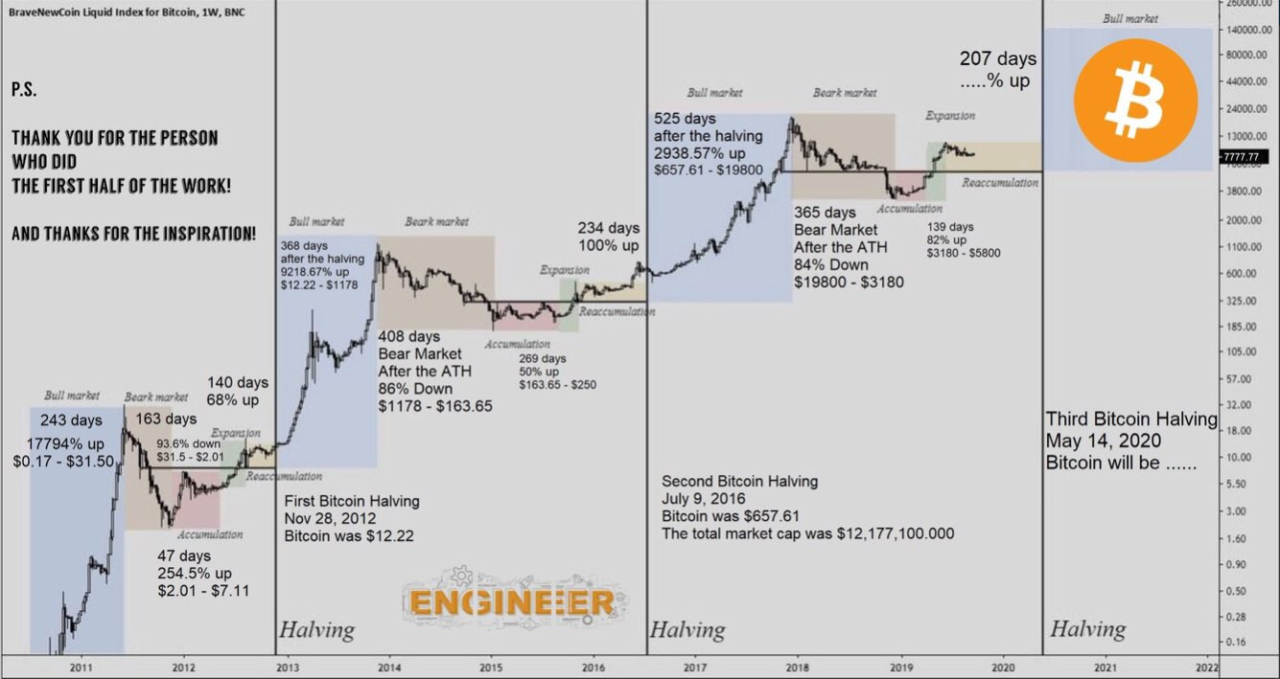

The first Bitcoin halving occurred on November 28, 2012, when the block reward was reduced from 50 new Bitcoins per block to 25 new Bitcoins per block. The second halving occurred on July 9, 2016, when the block reward was reduced from 25 new Bitcoins per block to 12.5 new Bitcoins per block. The third halving occurred on May 11, 2020, when the block reward was reduced from 12.5 new Bitcoins per block to 6.25 new Bitcoins per block.

Effect of Bitcoin Halving on Supply and Demand

The halving has a direct impact on the supply of new Bitcoins that are being added to the network. By reducing the block reward, the halving limits the number of new coins that are being created and added to the network. This reduction in supply can have a positive effect on the price of Bitcoin, as the reduced supply can lead to increased demand.

The halving also has an impact on the demand for Bitcoin. As the block reward is reduced, miners may need to rely on transaction fees to remain profitable. This can lead to increased transaction fees, which can make Bitcoin more attractive to investors who are looking for a store of value or a hedge against inflation.

Impact of Bitcoin Halving on Miners

The halving has a significant impact on Bitcoin miners, as it reduces the block reward and limits the number of new coins that are being created and added to the network. This reduction in block reward can make it more difficult for miners to remain profitable, as they may need to rely on transaction fees to make up for the reduced block reward.

To remain profitable, miners may need to upgrade their equipment and increase their efficiency. This can lead to increased competition among miners, which can drive down the cost of mining and make the network more secure. The halving can also lead to consolidation in the mining industry, as smaller miners may struggle to remain profitable.

Impact of Bitcoin Halving on Investors

The halving can have a significant impact on investors, as it can lead to increased volatility in the price of Bitcoin. The reduction in block reward can lead to increased demand for Bitcoin, which can drive up the price. However, the increased volatility can also lead to increased risk, as the price of Bitcoin can fluctuate rapidly.

Investors who are looking to invest in Bitcoin should be aware of the potential risks and rewards associated with the halving. The event can provide an opportunity for investors to buy into the market at a lower price, but it can also lead to increased losses if the price of Bitcoin declines.

Strategies for Investing in Bitcoin During the Halving

Investors who are looking to invest in Bitcoin during the halving should consider the following strategies:

- Buy and Hold: One strategy is to buy and hold Bitcoin, as the reduced supply can lead to increased demand and a higher price.

- Dollar-Cost Averaging: Another strategy is to use dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the price of Bitcoin.

- Stop-Loss Orders: Investors can also use stop-loss orders to limit their losses if the price of Bitcoin declines.

- Hedging: Investors can also use hedging strategies, such as buying put options or selling call options, to reduce their exposure to the volatility of the Bitcoin market.

Conclusion

In conclusion, the Bitcoin halving is a significant event that can have a profound impact on the price of Bitcoin and the broader cryptocurrency market. The reduction in block reward can lead to increased demand for Bitcoin, which can drive up the price. However, the increased volatility can also lead to increased risk, as the price of Bitcoin can fluctuate rapidly.

Investors who are looking to invest in Bitcoin should be aware of the potential risks and rewards associated with the halving. By considering the strategies outlined above and doing their own research, investors can make informed decisions about investing in Bitcoin during the halving.

Future of Bitcoin Halving

The Bitcoin halving is a predictable event that is written into the Bitcoin protocol. The next halving is expected to occur in 2024, when the block reward will be reduced from 6.25 new Bitcoins per block to 3.125 new Bitcoins per block.

As the Bitcoin network continues to evolve, it is likely that the halving will remain a significant event in the cryptocurrency calendar. The reduction in block reward can lead to increased demand for Bitcoin, which can drive up the price and make the network more secure.

However, the halving can also lead to increased risk, as the reduced block reward can make it more difficult for miners to remain profitable. To remain profitable, miners may need to rely on transaction fees, which can lead to increased competition and consolidation in the mining industry.

Challenges and Opportunities

The Bitcoin halving presents both challenges and opportunities for investors, miners, and the broader cryptocurrency market. The reduction in block reward can lead to increased volatility, which can make it more difficult for investors to predict the price of Bitcoin.

However, the increased volatility can also provide opportunities for investors to buy into the market at a lower price. The halving can also lead to increased innovation, as miners and developers look for new ways to remain profitable and improve the efficiency of the network.

Regulatory Environment

The regulatory environment for Bitcoin and other cryptocurrencies is constantly evolving. The halving can provide an opportunity for regulators to reassess their approach to cryptocurrency and provide clearer guidance on the rules and regulations that apply to the industry.

However, the regulatory environment can also pose challenges for investors and miners, as unclear or conflicting regulations can create uncertainty and risk. To navigate the regulatory environment, investors and miners should stay informed about the latest developments and seek advice from qualified professionals.

Community Reaction

The Bitcoin community has reacted with excitement and anticipation to the halving. Many investors and miners see the event as a significant milestone in the development of the Bitcoin network and a chance to increase their profits.

However, others have expressed concerns about the potential risks and challenges associated with the halving. Some have warned that the reduced block reward could lead to increased volatility and make it more difficult for miners to remain profitable.

Investor Sentiment

Investor sentiment towards Bitcoin is highly variable and can be influenced by a range of factors, including the halving. Some investors see the halving as a positive event that can drive up the price of Bitcoin, while others are more cautious and see the event as a potential risk.

To navigate the complexities of investor sentiment, it is essential to stay informed about the latest developments in the cryptocurrency market and to seek advice from qualified professionals. Investors should also be aware of their own risk tolerance and investment goals, and adjust their strategies accordingly.

Final Thoughts

In conclusion, the Bitcoin halving is a significant event that can have a profound impact on the price of Bitcoin and the broader cryptocurrency market. The reduction in block reward can lead to increased demand for Bitcoin, which can drive up the price and make the network more secure.

However, the increased volatility can also lead to increased risk, as the price of Bitcoin can fluctuate rapidly. Investors who are looking to invest in Bitcoin should be aware of the potential risks and rewards associated with the halving and consider the strategies outlined above.

By staying informed and doing their own research, investors can make informed decisions about investing in Bitcoin during the halving. The event presents both challenges and opportunities, and it is essential to approach it with caution and a clear understanding of the potential risks and rewards.

Leave a Reply