The world of cryptocurrency has been plagued by various scams and schemes, with pump-and-dump schemes being one of the most prevalent. These schemes have resulted in significant financial losses for many investors, and it’s essential to be aware of the warning signs to avoid falling victim. In this article, we’ll delve into the world of cryptocurrency pump-and-dump schemes, explaining how they work, and most importantly, how to avoid them.

What are Pump-and-Dump Schemes?

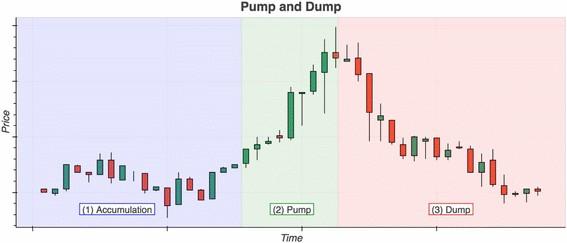

A pump-and-dump scheme is a type of scam where a group of individuals artificially inflate the price of a cryptocurrency by spreading false or misleading information. The goal is to create a sense of urgency and excitement around the cryptocurrency, which leads to a surge in buying activity. As the price rises, the scammers sell their holdings, causing the price to plummet and leaving innocent investors with significant losses.

How Do Pump-and-Dump Schemes Work?

Pump-and-dump schemes typically follow a predictable pattern:

- Selection of a target cryptocurrency: The scammers choose a relatively unknown or low-valued cryptocurrency with a small market capitalization.

- Creation of a hype: The scammers spread false or misleading information about the cryptocurrency, such as fake partnerships, upgrades, or adoption by major companies. This information is often disseminated through social media, online forums, and messaging apps.

- Artificial price inflation: As the fake news spreads, more and more people buy the cryptocurrency, causing the price to rise.

- Dumping: The scammers sell their holdings at the peak of the price, causing the price to collapse.

- Repeat: The scammers may repeat the process with the same cryptocurrency or move on to a new target.

Warning Signs of a Pump-and-Dump Scheme

To avoid falling victim to a pump-and-dump scheme, it’s crucial to be aware of the following warning signs:

- Unsolicited investment advice: Be cautious of unsolicited investment advice, especially if it comes from an unknown or unverified source.

- Overly promotional language: Be wary of language that promises unusually high returns or uses overly promotional tone.

- Lack of transparency: Be suspicious of cryptocurrencies with unclear or complex whitepapers, or those that lack a clear roadmap.

- Unrealistic price predictions: Be cautious of predictions that seem too good to be true or are based on unverifiable information.

- Pressure to invest quickly: Be wary of investment opportunities that create a sense of urgency or pressure you to invest quickly.

- Unclear or unregistered investment opportunities: Be cautious of investment opportunities that are not registered with regulatory bodies or have unclear terms and conditions.

How to Protect Yourself from Pump-and-Dump Schemes

To avoid falling victim to pump-and-dump schemes, follow these best practices:

- Conduct thorough research: Research the cryptocurrency thoroughly, including its whitepaper, roadmap, and development team.

- Verify information: Verify any information you receive about a cryptocurrency through reputable sources, such as official websites, social media channels, and news outlets.

- Be cautious of FOMO: Don’t invest based on fear of missing out (FOMO). Take your time to research and evaluate investment opportunities.

- Diversify your portfolio: Diversify your portfolio by investing in a variety of assets, including established cryptocurrencies and traditional assets.

- Use reputable exchanges: Use reputable and well-established cryptocurrency exchanges, which have robust security measures and transparency.

- Keep your assets secure: Keep your cryptocurrency assets secure by using hardware wallets, two-factor authentication, and encrypted wallets.

- Stay informed: Stay informed about market trends and developments, but be cautious of misinformation and biased sources.

Red Flags to Watch Out For

When evaluating a cryptocurrency investment opportunity, watch out for the following red flags:

- Guaranteed returns: Be wary of investment opportunities that guarantee high returns or promise unusually high yields.

- Complex investment structures: Be cautious of investment opportunities with complex investment structures, such as multi-level marketing schemes or Ponzi schemes.

- Lack of regulatory compliance: Be wary of investment opportunities that are not registered with regulatory bodies or have unclear terms and conditions.

- Unprofessional communication: Be cautious of investment opportunities with unprofessional communication, such as poor grammar, spelling mistakes, or unresponsive customer support.

- Pressure to invest in a specific cryptocurrency: Be wary of investment opportunities that pressure you to invest in a specific cryptocurrency or scheme.

Regulatory Efforts to Combat Pump-and-Dump Schemes

Regulatory bodies have taken steps to combat pump-and-dump schemes, including:

- Increased scrutiny: Regulatory bodies have increased scrutiny of cryptocurrency exchanges, trading platforms, and investment opportunities.

- Registration requirements: Regulatory bodies have introduced registration requirements for cryptocurrency exchanges, trading platforms, and investment opportunities.

- Anti-money laundering (AML) and know-your-customer (KYC) regulations: Regulatory bodies have introduced AML and KYC regulations to prevent the use of cryptocurrencies for illicit activities.

- Education and awareness campaigns: Regulatory bodies have launched education and awareness campaigns to inform investors about the risks of pump-and-dump schemes.

Conclusion

Pump-and-dump schemes are a significant threat to the cryptocurrency market, and it’s essential to be aware of the warning signs to avoid falling victim. By conducting thorough research, verifying information, and being cautious of FOMO, you can protect yourself from these schemes. Regulatory bodies are also taking steps to combat pump-and-dump schemes, including increased scrutiny, registration requirements, and education and awareness campaigns. Remember, investing in cryptocurrencies carries risks, and it’s crucial to approach investment opportunities with a critical and nuanced perspective. Always prioritize caution and due diligence to ensure a safe and successful investment experience.

Additional Tips

In addition to the best practices mentioned earlier, here are some additional tips to help you avoid falling victim to pump-and-dump schemes:

- Monitor social media and online forums: Keep an eye on social media and online forums for any suspicious or promotional activity related to a particular cryptocurrency.

- Use blockchain analytics tools: Use blockchain analytics tools to track the movement of funds and identify any suspicious activity.

- Stay up-to-date with market news: Stay informed about market trends and developments, but be cautious of misinformation and biased sources.

- Use a reputable wallet: Use a reputable wallet to store your cryptocurrency assets, and keep your private keys secure.

- Consider seeking professional advice: Consider seeking professional advice from a financial advisor or investment expert before making any investment decisions.

By following these tips and being aware of the warning signs of pump-and-dump schemes, you can protect yourself from these scams and enjoy a safe and successful investment experience in the cryptocurrency market.

Leave a Reply