The world of cryptocurrency has experienced a remarkable surge in popularity over the past decade, with numerous investors and traders flocking to capitalize on the lucrative opportunities presented by this burgeoning market. However, the volatility and unpredictability associated with direct cryptocurrency investments can be daunting, especially for those who are new to the space. This is where cryptocurrency exchange-traded funds (ETFs) come in, offering a more accessible and diversified way to participate in the crypto market.

In this article, we will delve into the benefits and drawbacks of crypto ETF investments, providing an in-depth analysis of the advantages and disadvantages associated with these products.

What Are Crypto ETFs?

A cryptocurrency ETF is a type of investment fund that tracks the performance of a specific cryptocurrency or a basket of cryptocurrencies. These funds are traded on a regulated exchange, such as the New York Stock Exchange (NYSE) or NASDAQ, and offer investors exposure to the crypto market without requiring them to hold the underlying assets directly.

Crypto ETFs typically invest in a variety of assets, such as:

- Cryptocurrencies: The ETF may invest directly in a specific cryptocurrency, such as Bitcoin or Ethereum.

- Derivatives: The ETF may invest in derivatives, such as futures contracts or options, that track the price movement of a particular cryptocurrency.

- Index Funds: The ETF may track a specific cryptocurrency index, such as the Bloomberg Galaxy Crypto Index (BGCI), which provides a comprehensive measure of the performance of the crypto market.

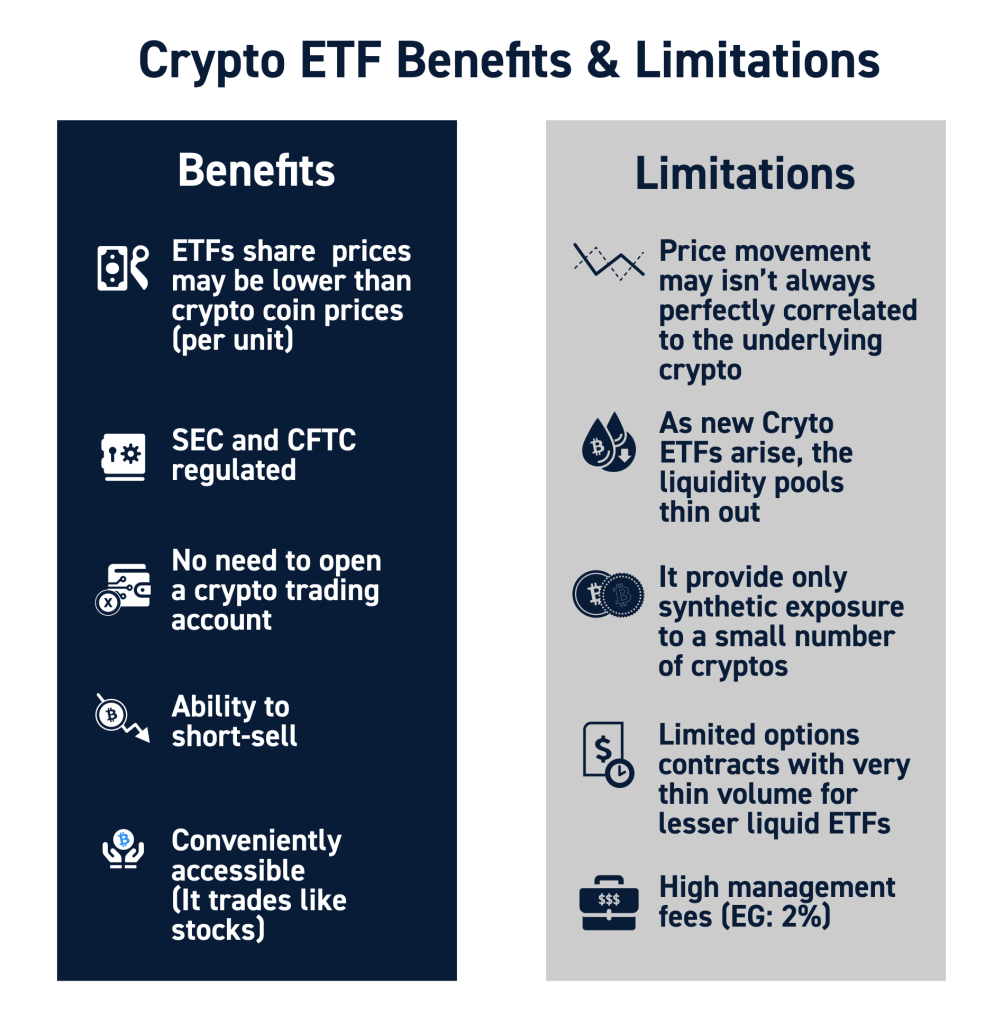

Benefits of Crypto ETF Investments

- Diversification: Crypto ETFs offer a diversified portfolio of assets, which can help to mitigate the risks associated with investing in individual cryptocurrencies. By spreading investments across a range of assets, investors can reduce their exposure to market volatility and potential losses.

- Regulatory Compliance: Crypto ETFs are traded on regulated exchanges and are subject to strict regulatory requirements. This provides investors with added peace of mind, knowing that their investments are compliant with relevant laws and regulations.

- Access to Institutional Investors: Crypto ETFs provide institutional investors, such as pension funds and endowments, with a secure and compliant way to access the crypto market. This can lead to increased institutional investment in the space, which can help to drive growth and stability.

- Convenience and Ease of Use: Crypto ETFs offer investors a convenient and user-friendly way to participate in the crypto market. They can be traded through a brokerage account, just like traditional stocks or bonds, eliminating the need for specialized knowledge or equipment.

- Tax Efficiency: Crypto ETFs can provide tax benefits to investors, as they can be held in a tax-deferred retirement account, such as a 401(k) or IRA. This can help to minimize tax liabilities and optimize investment returns.

Drawbacks of Crypto ETF Investments

- Fees and Expenses: Crypto ETFs are not without costs, as investors must pay management fees, trading fees, and other expenses associated with these funds. These fees can erode investment returns and reduce the overall profitability of the investment.

- Tracking Error: Crypto ETFs may not perfectly track the performance of the underlying assets, which can result in tracking error. This can lead to lower investment returns and reduced efficiency.

- Counterparty Risk: Crypto ETFs may be exposed to counterparty risk, which arises from the potential failure of a counterparty to meet its obligations. This can result in losses for investors if the counterparty defaults on its obligations.

- Liquidity Risk: Crypto ETFs may be subject to liquidity risk, which arises from the potential lack of sufficient liquidity in the market. This can result in difficulties in buying or selling shares, which can impact investment returns.

- Security Risks: Crypto ETFs may be exposed to security risks, such as hacking and cyber attacks, which can result in losses for investors if the fund’s assets are compromised.

How to Invest in Crypto ETFs

Investing in crypto ETFs is relatively straightforward, as they can be traded through a brokerage account. Here are the general steps to follow:

- Open a Brokerage Account: Investors can open a brokerage account with a reputable online broker that offers crypto ETFs.

- Fund the Account: Investors can fund their account using a variety of payment methods, such as wires, checks, or wire transfers.

- Select the ETF: Investors can select the desired crypto ETF and place a trade using the brokerage account.

- Monitor and Adjust: Investors can monitor their investment and adjust their portfolio as needed to optimize returns and minimize risks.

Conclusion

Crypto ETFs offer investors a convenient and diversified way to participate in the crypto market, with benefits such as regulatory compliance, access to institutional investors, and tax efficiency. However, these funds are not without drawbacks, such as fees and expenses, tracking error, counterparty risk, liquidity risk, and security risks.

As with any investment, it is essential to carefully evaluate the pros and cons of crypto ETFs before making a decision. Investors should also conduct thorough research, consult with financial advisors, and develop a comprehensive investment strategy to optimize returns and minimize risks.

Ultimately, crypto ETFs can provide a valuable addition to a diversified investment portfolio, offering a unique opportunity to capitalize on the growth and innovation of the crypto market.

Leave a Reply