The rise of cryptocurrencies has led to an increased need for secure and reliable storage solutions. One such solution is crypto custodians, which have become an essential component of the cryptocurrency ecosystem. In this article, we will delve into the world of crypto custodians, exploring their role, how they work, and the benefits they offer.

What are Crypto Custodians?

A crypto custodian is a third-party entity that securely stores, manages, and protects cryptocurrencies on behalf of their clients. These custodians provide a secure and reliable way for individuals and institutions to hold, transfer, and manage their cryptocurrency assets. They act as a trusted intermediary between the client and the blockchain, ensuring that the client’s assets are safe from potential threats such as hacking, theft, and other malicious activities.

Types of Crypto Custodians

There are several types of crypto custodians, each offering different levels of security and services:

- Cold Storage Custodians: These custodians store cryptocurrency assets in an offline environment, often using physical devices such as USB drives or hardware wallets. Cold storage is considered one of the most secure forms of storage, as it is not connected to the internet and therefore less vulnerable to hacking.

- Hot Storage Custodians: These custodians store cryptocurrency assets in an online environment, often using software wallets or online platforms. Hot storage is more convenient than cold storage, as it allows for quicker access to funds, but it is also more vulnerable to hacking.

- Custodial Exchange: Some cryptocurrency exchanges offer custodial services, where they hold and manage clients’ assets on their behalf. Custodial exchanges are regulated by the relevant authorities and are subject to anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Non-Custodial Wallets: These wallets allow users to manage their own private keys and control their assets without relying on a third-party custodian. Non-custodial wallets offer greater security and control, but require users to take responsibility for securing their own assets.

How Do Crypto Custodians Work?

Crypto custodians typically follow a similar process to secure and manage clients’ assets:

- Account Opening: Clients create an account with the custodian, providing required information such as identification documents, proof of address, and other verification details.

- Asset Transfer: Clients transfer their cryptocurrency assets to the custodian’s wallets, using a secure transfer process.

- Storage: The custodian stores the assets in a secure environment, such as a cold storage facility or a secure online platform.

- Management: The custodian manages the assets on behalf of the client, performing tasks such as asset allocation, rebalancing, and monitoring market movements.

- Reporting: The custodian provides regular statements and reports to the client, detailing their asset holdings, transactions, and performance.

- Withdrawal: Clients can withdraw their assets from the custodian, using a secure withdrawal process.

Benefits of Using a Crypto Custodian

Using a crypto custodian offers several benefits, including:

- Security: Crypto custodians offer a high level of security, protecting assets from hacking, theft, and other malicious activities.

- Regulatory Compliance: Custodians are subject to regulatory requirements, such as AML and KYC, which ensure that assets are held in compliance with relevant laws and regulations.

- Expertise: Crypto custodians have expertise in managing and securing cryptocurrency assets, freeing up clients to focus on other activities.

- Scalability: Custodians can handle large volumes of assets, making them an attractive solution for institutions and individuals with significant holdings.

- Insurance: Some custodians offer insurance coverage for assets, providing an additional layer of protection.

- Convenience: Custodians provide a one-stop-shop for clients, offering a range of services from storage and management to reporting and withdrawal.

Risks and Challenges of Using a Crypto Custodian

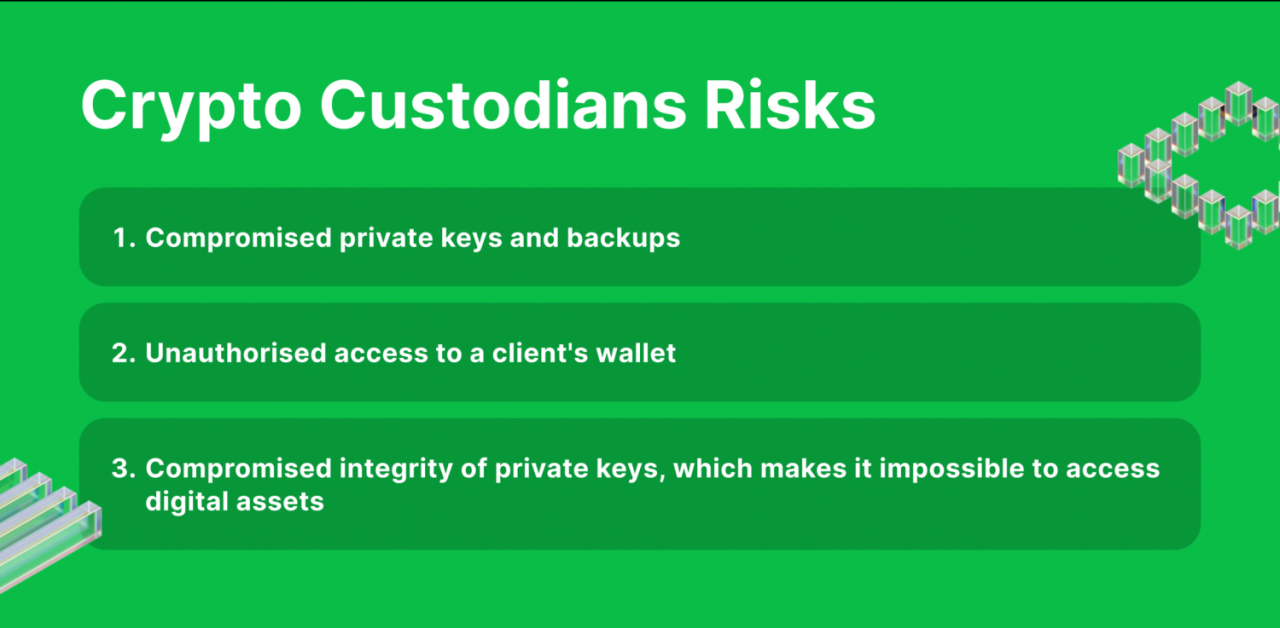

While crypto custodians offer several benefits, there are also risks and challenges associated with using their services:

- Counterparty Risk: Clients are exposed to the risk that the custodian may fail or become insolvent, which could result in the loss of assets.

- Security Risks: Custodians are not immune to security breaches, which could result in the theft or loss of assets.

- Regulatory Risk: Custodians are subject to changing regulatory requirements, which could impact their ability to offer services.

- Censorship: Custodians may be required to freeze or seize assets at the request of regulatory authorities, which could impact clients’ access to their assets.

Best Practices for Choosing a Crypto Custodian

When selecting a crypto custodian, consider the following best practices:

- Research: Research the custodian’s reputation, security measures, and regulatory compliance.

- Experience: Look for a custodian with experience in managing and securing cryptocurrency assets.

- Insurance: Consider a custodian that offers insurance coverage for assets.

- Security: Evaluate the custodian’s security measures, including encryption, multi-signature wallets, and physical security.

- Regulatory Compliance: Ensure that the custodian is subject to regulatory requirements, such as AML and KYC.

Conclusion

Crypto custodians play a vital role in the cryptocurrency ecosystem, providing a secure and reliable way for individuals and institutions to hold, transfer, and manage their assets. While there are benefits to using a crypto custodian, there are also risks and challenges associated with their services. By understanding how crypto custodians work and following best practices for selecting a custodian, clients can ensure that their assets are secure and their interests are protected.

In conclusion, crypto custodians offer a range of benefits, including security, regulatory compliance, expertise, scalability, insurance, and convenience. While there are risks and challenges associated with using their services, a well-chosen custodian can provide peace of mind and protection for clients’ assets. As the cryptocurrency landscape continues to evolve, it is likely that crypto custodians will play an increasingly important role in shaping the future of digital assets.

Leave a Reply