Yield farming, also known as liquidity mining, has become a popular concept in the cryptocurrency space. It allows investors to earn passive income by providing liquidity to decentralized finance (DeFi) protocols. In this article, we will delve into the world of yield farming, exploring its basics, benefits, and strategies to maximize returns.

What is Yield Farming?

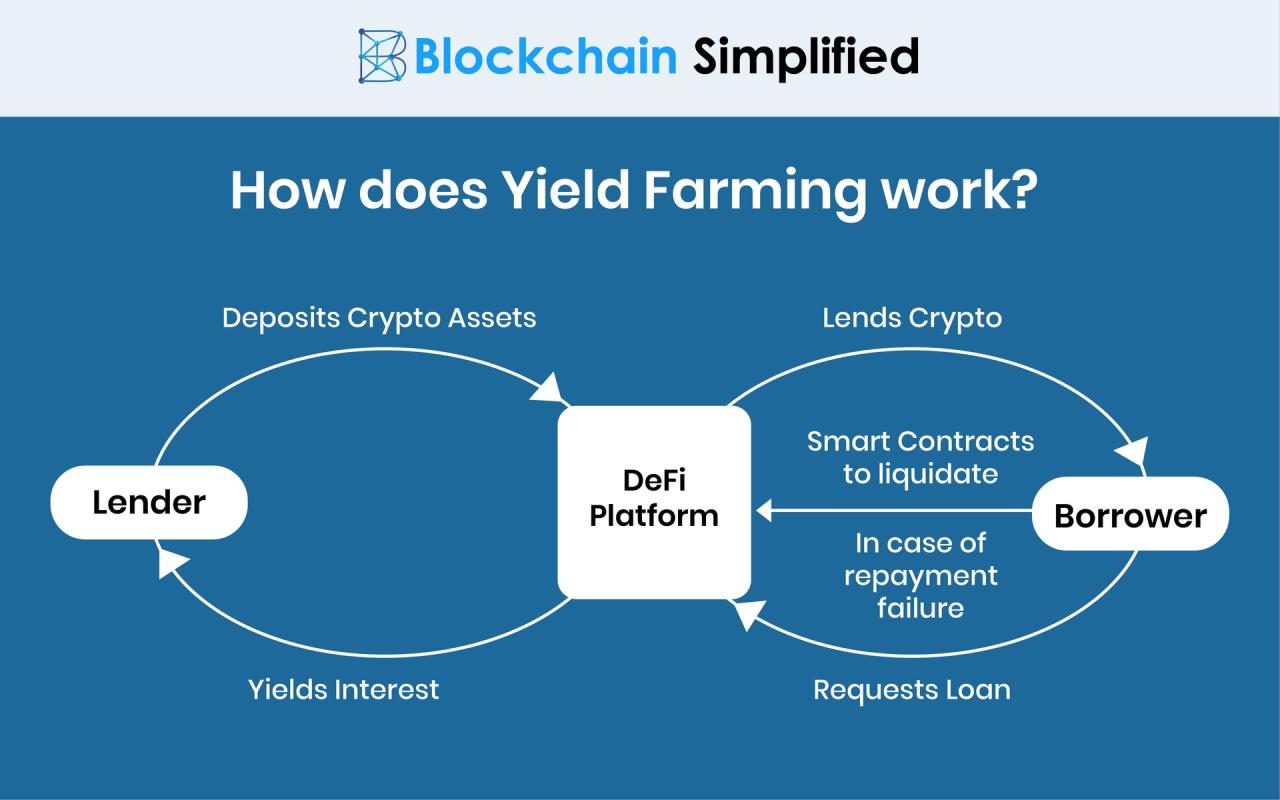

Yield farming is a process where investors lend their cryptocurrencies to DeFi protocols, such as decentralized exchanges (DEXs), lending platforms, and stablecoin issuers, in exchange for interest payments and other incentives. These incentives can come in the form of tokens, which can be sold or used to participate in other DeFi activities.

The concept of yield farming is similar to traditional banking, where depositors earn interest on their savings accounts. However, in DeFi, the interest rates are often much higher, and the risks are also greater. Yield farming has gained popularity due to its potential for high returns and the ability to participate in the growing DeFi ecosystem.

How Does Yield Farming Work?

Yield farming typically involves the following steps:

- Choose a DeFi Protocol: Investors select a DeFi protocol that offers yield farming opportunities, such as Compound, Aave, or Uniswap.

- Deposit Cryptocurrencies: Investors deposit their cryptocurrencies into the protocol’s liquidity pool.

- Earn Interest and Incentives: The protocol uses the deposited funds to facilitate lending, borrowing, or trading activities, generating interest and incentives for the investors.

- Claim Rewards: Investors can claim their rewards, which can be in the form of tokens, interest payments, or other benefits.

Types of Yield Farming

There are several types of yield farming strategies, including:

- Lending: Investors lend their cryptocurrencies to borrowers, earning interest payments.

- Liquidity Providing: Investors provide liquidity to DEXs, earning trading fees and other incentives.

- Stablecoin Farming: Investors deposit stablecoins into protocols, earning interest payments and other rewards.

- Token-Based Yield Farming: Investors deposit tokens into protocols, earning additional tokens and other incentives.

Benefits of Yield Farming

Yield farming offers several benefits, including:

- Passive Income: Investors can earn passive income without actively trading or managing their investments.

- High Returns: Yield farming can offer higher returns than traditional investments, such as savings accounts or bonds.

- Diversification: Yield farming allows investors to diversify their portfolios by participating in different DeFi protocols and assets.

- Participation in DeFi: Yield farming enables investors to participate in the growing DeFi ecosystem, supporting the development of new financial applications and services.

Risks and Challenges

Yield farming also involves several risks and challenges, including:

- Smart Contract Risks: DeFi protocols rely on smart contracts, which can be vulnerable to bugs, hacks, or other security issues.

- Market Volatility: Cryptocurrency markets can be highly volatile, affecting the value of deposited funds and earned incentives.

- Liquidity Risks: Investors may face liquidity risks if they need to withdraw their funds quickly, as DeFi protocols may not always have sufficient liquidity.

- Regulatory Risks: DeFi protocols may be subject to regulatory changes, which can impact the availability and attractiveness of yield farming opportunities.

Strategies to Maximize Returns

To maximize returns from yield farming, investors can follow these strategies:

- Diversify Across Protocols: Investors should diversify their investments across multiple DeFi protocols to minimize risks and maximize returns.

- Choose High-Yielding Assets: Investors should select high-yielding assets, such as stablecoins or tokens with high demand.

- Monitor and Adjust: Investors should regularly monitor their investments and adjust their strategies as market conditions change.

- Consider Leverage: Investors can consider using leverage to amplify their returns, but this also increases the risks.

- Stay Informed: Investors should stay informed about market trends, regulatory changes, and DeFi developments to make informed investment decisions.

Popular Yield Farming Platforms

Some popular yield farming platforms include:

- Compound: A decentralized lending platform that allows investors to lend and borrow cryptocurrencies.

- Aave: A decentralized lending platform that offers flash loans and other DeFi services.

- Uniswap: A decentralized exchange that allows investors to provide liquidity and earn trading fees.

- Curve: A decentralized exchange liquidity pool that offers high-yielding opportunities for stablecoin investors.

- Yearn.finance: A yield aggregator that simplifies yield farming by automatically optimizing investment strategies.

Conclusion

Yield farming has become a popular way for investors to earn passive income in the cryptocurrency space. By providing liquidity to DeFi protocols, investors can earn interest payments, tokens, and other incentives. While yield farming offers high returns, it also involves risks and challenges, such as smart contract risks, market volatility, and liquidity risks. To maximize returns, investors should diversify across protocols, choose high-yielding assets, monitor and adjust their strategies, and stay informed about market trends and DeFi developments. By following these strategies and using popular yield farming platforms, investors can participate in the growing DeFi ecosystem and earn attractive returns on their investments.

Leave a Reply