The world of finance is undergoing a profound transformation, driven by the emergence of decentralized finance, commonly referred to as DeFi. This new paradigm is revolutionizing the way we think about money, financial services, and the role of traditional institutions. DeFi is built on blockchain technology, which enables secure, transparent, and decentralized transactions, allowing individuals to take control of their financial lives like never before. In this article, we will delve into the world of DeFi, exploring its core principles, key components, and the impact it is having on the financial landscape.

What is DeFi?

DeFi is a broad term that encompasses a range of financial services and systems that operate on blockchain networks, rather than traditional financial institutions. It includes lending, borrowing, trading, and investment platforms, as well as stablecoins, decentralized exchanges, and other financial instruments. The core idea behind DeFi is to create a more open, accessible, and transparent financial system, where individuals can participate without the need for intermediaries like banks or brokerages.

Key Components of DeFi

DeFi is built around several key components, including:

- Blockchain: The underlying technology that enables DeFi, blockchain is a distributed ledger that records transactions across a network of computers. This allows for secure, transparent, and tamper-proof transactions.

- Smart Contracts: Self-executing contracts with the terms of the agreement written directly into code, smart contracts are a crucial component of DeFi. They enable automated transactions and ensure that all parties comply with the terms of the agreement.

- Decentralized Applications (dApps): dApps are applications that run on blockchain networks, enabling users to interact with DeFi platforms and services.

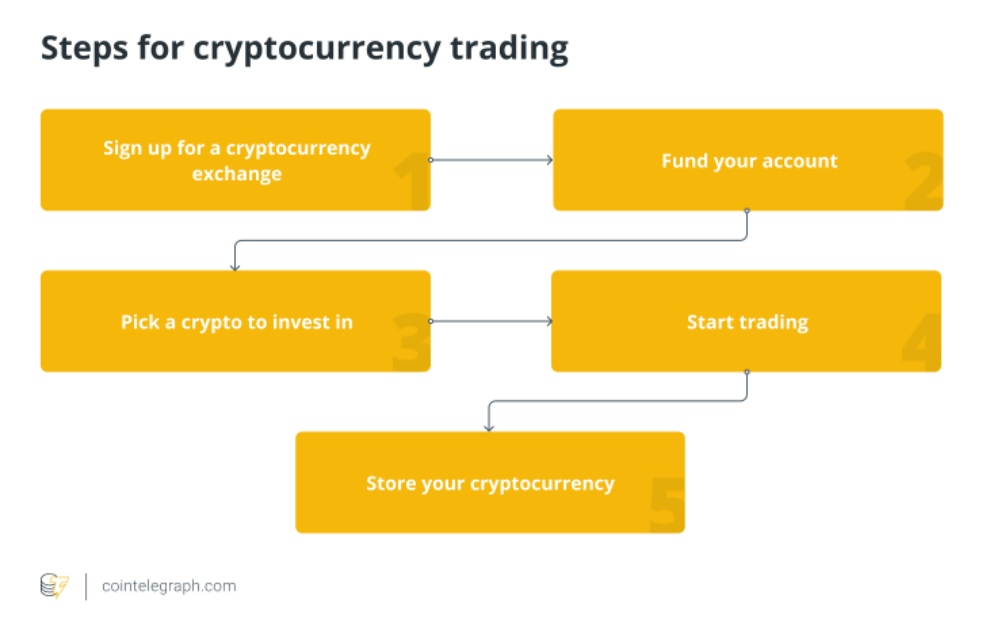

- Cryptocurrencies: Digital currencies like Bitcoin, Ethereum, and others are used to facilitate transactions and provide liquidity to DeFi platforms.

- Stablecoins: Pegged to the value of traditional currencies, stablecoins provide a stable store of value and medium of exchange within DeFi ecosystems.

How DeFi Works

DeFi platforms operate on blockchain networks, using smart contracts to facilitate transactions and ensure that all parties comply with the terms of the agreement. Here’s a step-by-step overview of how DeFi works:

- Users interact with dApps: Users access DeFi platforms through dApps, which provide a user-friendly interface for interacting with the platform.

- Transactions are executed: Users initiate transactions, which are executed on the blockchain network using smart contracts.

- Smart contracts enforce terms: Smart contracts automatically enforce the terms of the agreement, ensuring that all parties comply with the rules of the platform.

- Transactions are recorded: Transactions are recorded on the blockchain, providing a transparent and tamper-proof record of all activity on the platform.

Benefits of DeFi

DeFi offers a range of benefits, including:

- Increased accessibility: DeFi platforms provide access to financial services for individuals who may be excluded from traditional financial systems.

- Improved transparency: DeFi transactions are recorded on a public blockchain, providing a transparent and tamper-proof record of all activity.

- Enhanced security: DeFi platforms use advanced cryptography and smart contracts to secure transactions and protect user funds.

- Increased efficiency: DeFi platforms automate many processes, reducing the need for intermediaries and increasing the speed of transactions.

- Reduced costs: DeFi platforms can reduce costs by eliminating the need for intermediaries and minimizing the need for manual processing.

Challenges and Limitations

While DeFi offers many benefits, it also faces several challenges and limitations, including:

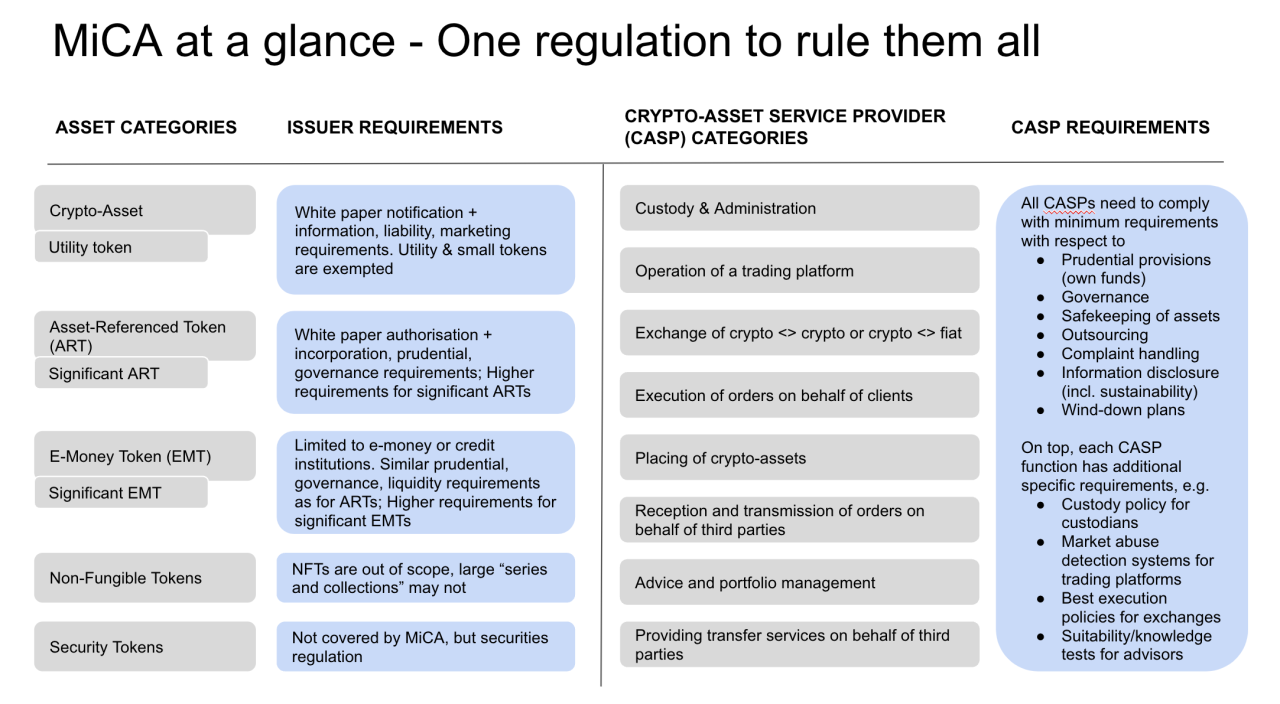

- Regulatory uncertainty: The regulatory environment for DeFi is still evolving, creating uncertainty and risk for users and platforms.

- Scalability: DeFi platforms are still in the early stages of development, and many platforms face scalability challenges as they grow.

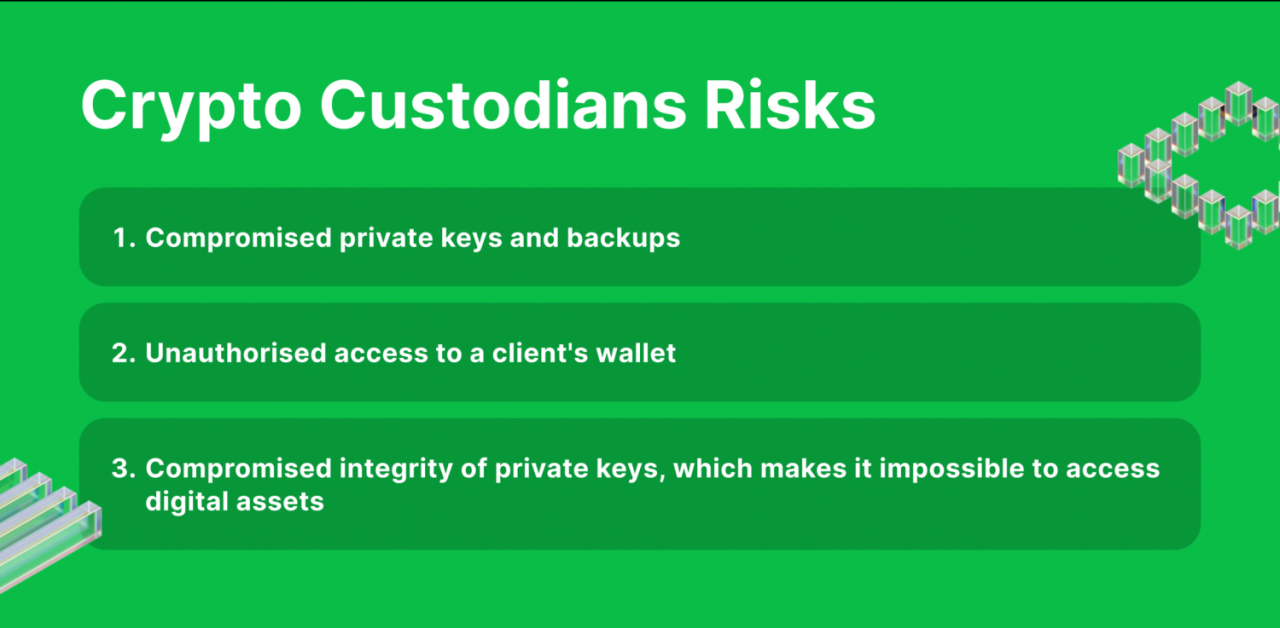

- Security risks: DeFi platforms are not immune to security risks, and users must take steps to protect their funds and personal data.

- Usability: DeFi platforms can be complex and difficult to use, creating barriers to adoption for new users.

- Market volatility: DeFi platforms are subject to market volatility, which can create risks for users and platforms.

Real-World Applications of DeFi

DeFi has a range of real-world applications, including:

- Lending and borrowing: DeFi platforms enable users to lend and borrow cryptocurrencies, providing a new source of income and financing options.

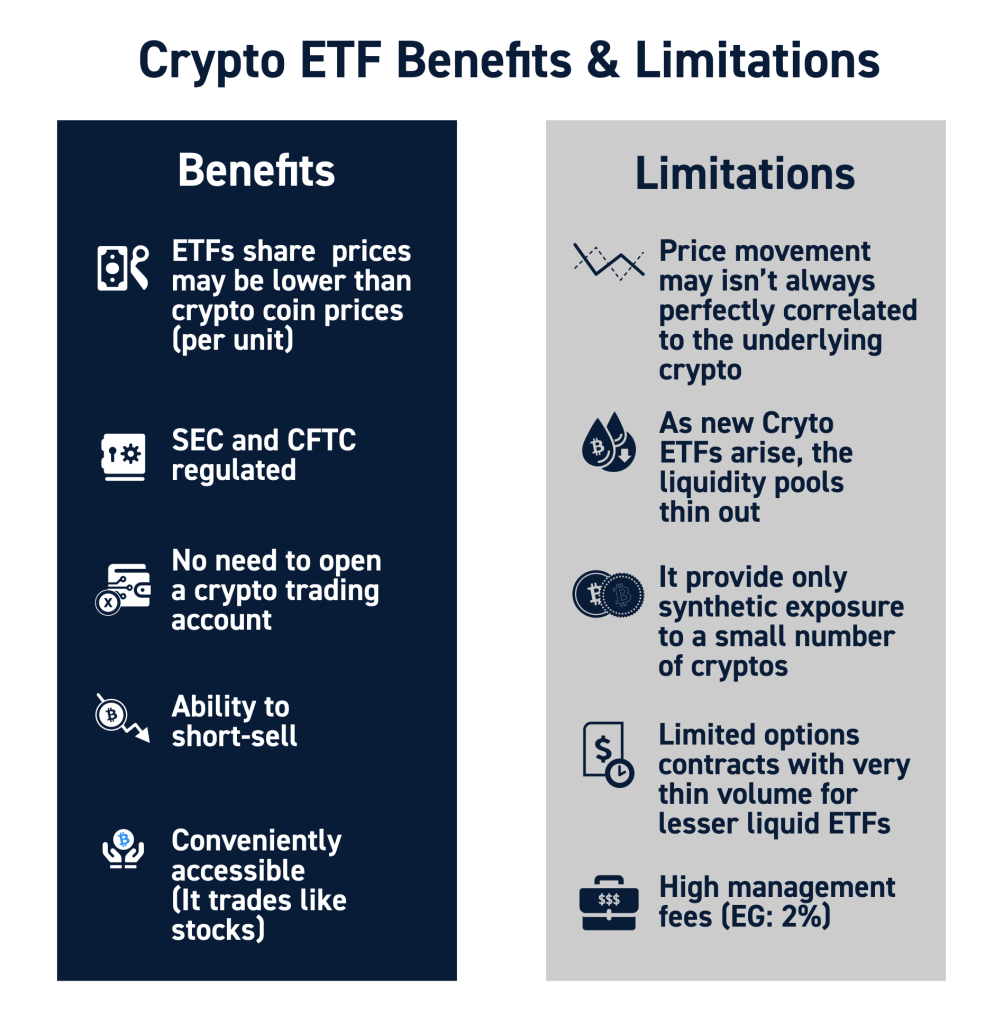

- Trading and investment: DeFi platforms provide access to decentralized exchanges and investment opportunities, enabling users to trade and invest in a range of assets.

- Stablecoins and payments: DeFi platforms enable the creation and use of stablecoins, providing a stable store of value and medium of exchange.

- Insurance and risk management: DeFi platforms enable the creation of decentralized insurance products, providing users with new options for managing risk.

The Future of DeFi

The future of DeFi is promising, with many experts predicting that it will play a major role in shaping the financial landscape of the future. As DeFi continues to evolve, we can expect to see:

- Increased adoption: DeFi will become more mainstream, with more users and institutions participating in DeFi platforms and services.

- Improved regulation: Regulatory clarity will emerge, providing a more stable and secure environment for DeFi platforms and users.

- Advances in technology: DeFi platforms will become more sophisticated, with advances in areas like scalability, usability, and security.

- New applications and use cases: DeFi will enable new applications and use cases, such as decentralized finance, social impact investing, and community-driven financial initiatives.

Conclusion

DeFi is revolutionizing the world of finance, providing a new paradigm for financial services and systems. With its core principles of decentralization, transparency, and security, DeFi is creating a more open, accessible, and efficient financial system. While DeFi faces challenges and limitations, its potential to transform the financial landscape is vast. As DeFi continues to evolve, we can expect to see increased adoption, improved regulation, advances in technology, and new applications and use cases emerge. Whether you’re a seasoned investor or just starting to explore the world of finance, DeFi is an exciting and rapidly evolving space that’s worth watching.