Cryptocurrency trading has gained immense popularity over the years, with more and more investors seeking to capitalize on the volatility of the digital currency market. However, with the potential for high returns comes a corresponding level of risk. In fact, crypto trading is considered one of the riskiest forms of investment, with market fluctuations that can result in significant losses if not managed properly.

Effective risk management is therefore crucial for success in crypto trading. In this article, we will explore the importance of risk management in crypto trading and provide a step-by-step guide on how to implement a robust risk management strategy.

Why Risk Management is Critical in Crypto Trading

Before we delve into the nitty-gritty of risk management, it’s essential to understand why it’s critical in crypto trading. Here are some reasons why:

- Market Volatility: Crypto markets are known for their volatility, with prices fluctuating rapidly and unpredictably. Without a solid risk management strategy, traders can easily find themselves on the wrong side of a trade, resulting in significant losses.

- Unregulated Markets: Unlike traditional financial markets, crypto markets are largely unregulated, which means that there is no central authority to oversee trading activities. This lack of regulation can lead to market manipulation, scams, and other forms of fraud.

- Leverage Trading: Many crypto exchanges offer leverage trading options, which allow traders to borrow funds to amplify their trades. While leverage can be a powerful tool for maximizing gains, it can also exacerbate losses if not managed properly.

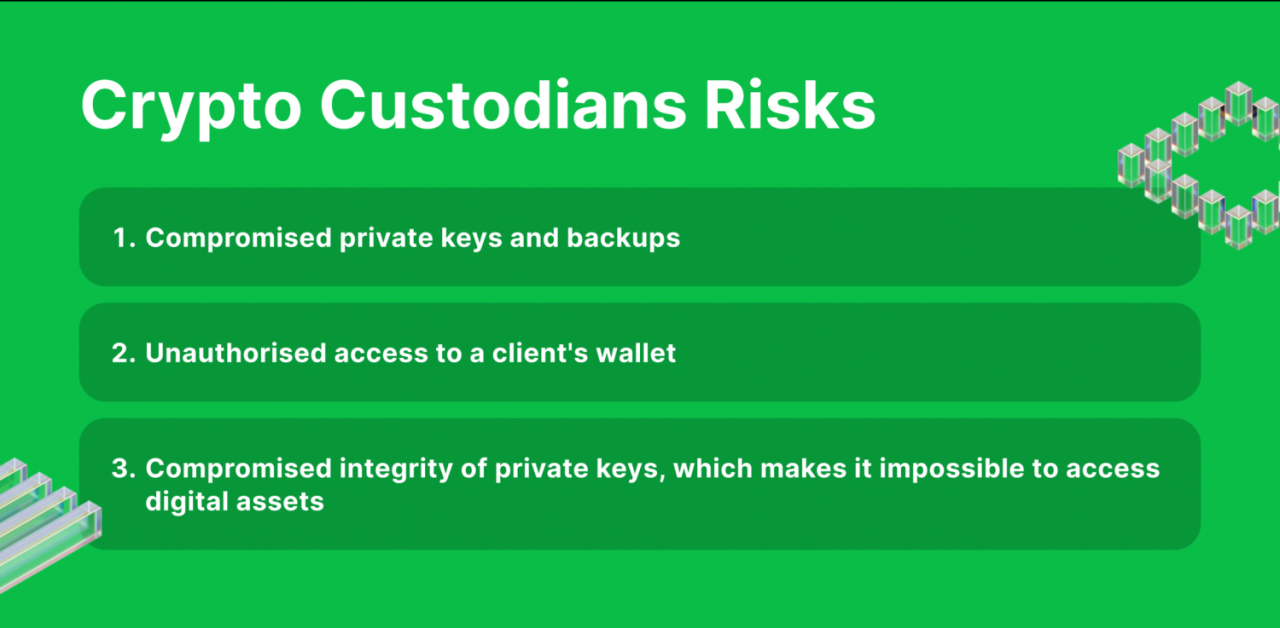

- Security Risks: Crypto trading involves the use of digital currencies and exchanges, which can be vulnerable to hacking and other forms of cyber attacks. A robust risk management strategy can help mitigate these risks.

Step 1: Assess Your Risk Tolerance

Before you start trading, it’s essential to assess your risk tolerance. Risk tolerance refers to your ability to withstand market fluctuations and potential losses. If you’re a conservative trader, you may want to stick to smaller positions and lower leverage. On the other hand, if you’re a more aggressive trader, you may be willing to take on more risk in pursuit of higher returns.

Here are some questions to help you assess your risk tolerance:

- What is your investment goal? Are you looking for short-term gains or long-term growth?

- How much can you afford to lose? Set a specific amount that you can afford to lose and stick to it.

- How do you react to market volatility? Do you get anxious or do you remain calm?

Step 2: Set Clear Trading Objectives

Once you’ve assessed your risk tolerance, it’s time to set clear trading objectives. Your objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). Here are some examples of SMART trading objectives:

- Specific: I want to increase my portfolio value by 20% within the next three months.

- Measurable: I will measure my progress by tracking my portfolio value on a daily basis.

- Achievable: I will allocate 10% of my portfolio to high-risk trades and 90% to low-risk trades.

- Relevant: My trading objectives align with my investment goals and risk tolerance.

- Time-bound: I will review and adjust my trading objectives every three months.

Step 3: Choose the Right Trading Strategy

Your trading strategy should be aligned with your risk tolerance and trading objectives. Here are some popular trading strategies:

- Day Trading: Day trading involves buying and selling cryptocurrencies within a short time frame, usually within a day. This strategy is suitable for traders with a high risk tolerance and a short-term focus.

- Swing Trading: Swing trading involves holding onto trades for a longer period, usually several days or weeks. This strategy is suitable for traders with a medium risk tolerance and a medium-term focus.

- Position Trading: Position trading involves holding onto trades for a longer period, usually several weeks or months. This strategy is suitable for traders with a low risk tolerance and a long-term focus.

Step 4: Set Stop-Loss Orders

Stop-loss orders are a crucial risk management tool that can help limit your losses in case of a market downturn. A stop-loss order is an instruction to sell a cryptocurrency when it reaches a certain price. Here are some tips for setting effective stop-loss orders:

- Set a percentage-based stop-loss: Set a stop-loss order that is based on a percentage of your position size. For example, if you buy 10,000 units of a cryptocurrency, you may set a stop-loss order to sell 20% of your position if the price falls by 10%.

- Set a price-based stop-loss: Set a stop-loss order that is based on a specific price level. For example, if you buy a cryptocurrency at $100, you may set a stop-loss order to sell if the price falls to $80.

- Adjust your stop-loss orders regularly: Adjust your stop-loss orders regularly to reflect changes in market conditions.

Step 5: Diversify Your Portfolio

Diversification is a key risk management strategy that can help minimize your exposure to market fluctuations. Here are some tips for diversifying your portfolio:

- Invest in a mix of cryptocurrencies: Invest in a mix of established and emerging cryptocurrencies to spread your risk.

- Invest in other asset classes: Invest in other asset classes, such as stocks, bonds, and commodities, to spread your risk.

- Use a balanced portfolio: Use a balanced portfolio that allocates your investments across different asset classes.

Step 6: Monitor and Adjust Your Positions

Finally, it’s essential to monitor and adjust your positions regularly to reflect changes in market conditions. Here are some tips for monitoring and adjusting your positions:

- Monitor market news and trends: Stay up-to-date with market news and trends to anticipate potential changes in market conditions.

- Use technical analysis: Use technical analysis to identify trends and patterns in market prices.

- Adjust your positions regularly: Adjust your positions regularly to reflect changes in market conditions.

Conclusion

Risk management is a critical component of successful crypto trading. By assessing your risk tolerance, setting clear trading objectives, choosing the right trading strategy, setting stop-loss orders, diversifying your portfolio, and monitoring and adjusting your positions, you can minimize your exposure to market fluctuations and maximize your returns. Remember, risk management is an ongoing process that requires regular monitoring and adjustment. By following these steps, you can develop a robust risk management strategy that can help you achieve your investment goals.

Additional Tips

Here are some additional tips for effective risk management in crypto trading:

- Use a demo account: Use a demo account to test your trading strategies and risk management techniques before trading with real money.

- Stay disciplined: Stay disciplined and avoid making impulsive trades based on emotions.

- Seek professional advice: Seek professional advice from a financial advisor or trading coach to help you develop a robust risk management strategy.

- Stay informed: Stay informed about market conditions and economic trends to anticipate potential changes in market conditions.

- Diversify your exchange accounts: Diversify your exchange accounts to minimize your exposure to exchange-related risks.

By following these tips and strategies, you can develop a robust risk management framework that can help you navigate the complexities of crypto trading and achieve your investment goals.