The world of cryptocurrency has exploded in recent years, with the rise of Bitcoin, Ethereum, and other digital assets. While cryptocurrency has the potential to be a lucrative investment, it also comes with significant risks, particularly when it comes to scams. As the popularity of cryptocurrency continues to grow, so do the number of scammers looking to take advantage of unsuspecting investors. In this article, we will explore the most common cryptocurrency scams and provide you with tips on how to avoid them and protect your investments.

Understanding Cryptocurrency Scams

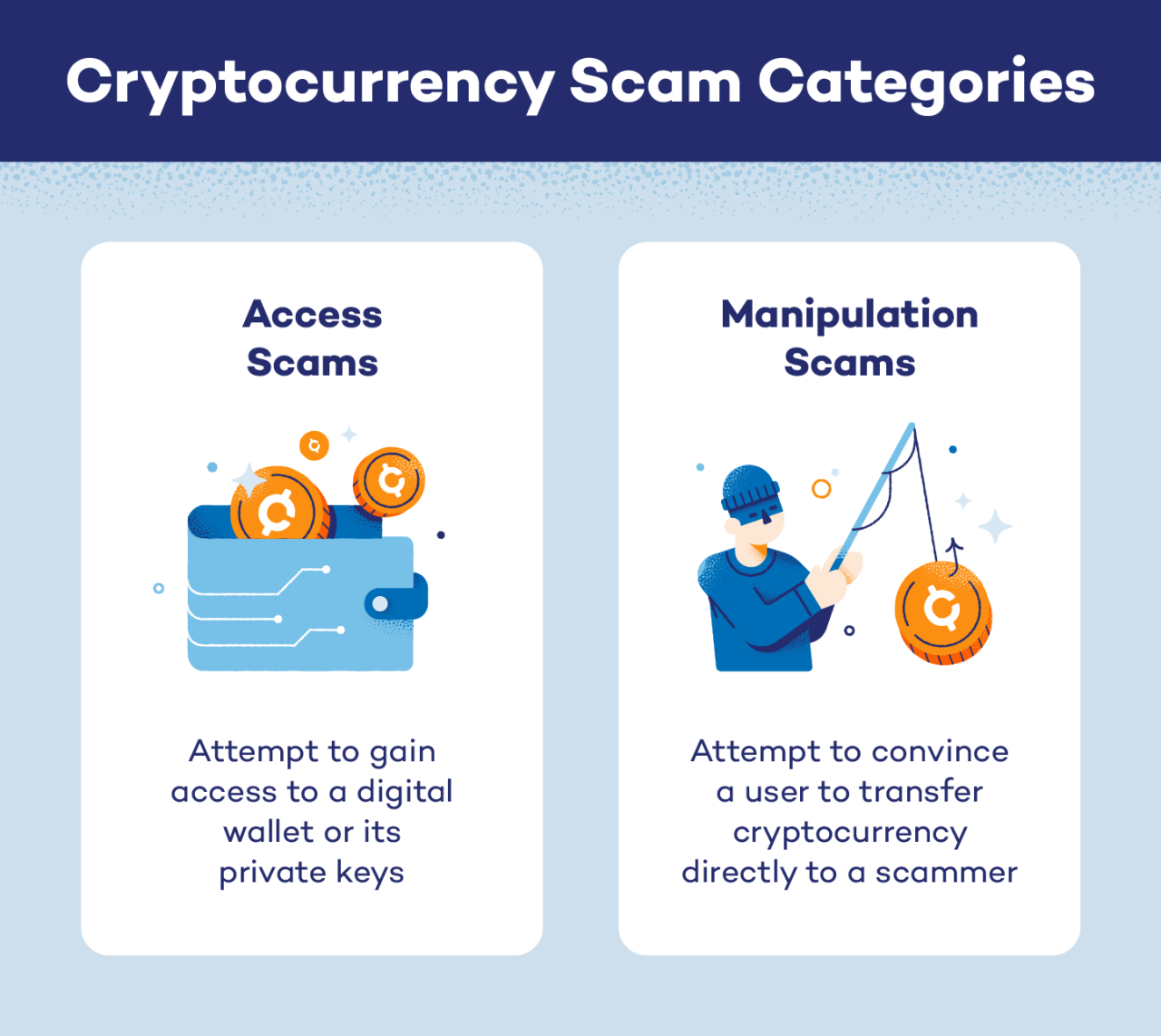

Cryptocurrency scams can take many forms, but they often involve deception, manipulation, and exploitation of investors. Scammers may use fake websites, social media profiles, and other tactics to lure victims into investing in their schemes. Some common cryptocurrency scams include:

- Phishing scams: Scammers create fake websites or emails that appear to be from a legitimate cryptocurrency exchange or wallet provider. They then trick victims into revealing their login credentials or private keys.

- Ponzi schemes: Scammers promise unusually high returns on investments, but instead of investing the funds, they use the money from new investors to pay off earlier investors.

- Fake ICOs: Scammers create fake Initial Coin Offerings (ICOs) to raise funds for a non-existent project.

- Social media scams: Scammers use social media platforms to promote fake investment opportunities or to phishing for sensitive information.

- Exchange hacks: Scammers hack into cryptocurrency exchanges to steal funds or sensitive information.

Tips to Avoid Cryptocurrency Scams

To avoid falling victim to cryptocurrency scams, follow these tips:

- Research, research, research: Before investing in any cryptocurrency or project, do your research. Look for reviews, ratings, and feedback from other investors.

- Verify the authenticity of websites and emails: Be cautious of fake websites and emails that appear to be from a legitimate cryptocurrency exchange or wallet provider. Check for spelling mistakes, grammar errors, and other signs of deception.

- Use strong passwords and two-factor authentication: Use strong, unique passwords for all of your cryptocurrency accounts, and enable two-factor authentication to add an extra layer of security.

- Be wary of unsolicited investment offers: If someone approaches you with an investment opportunity that seems too good to be true, it probably is. Be cautious of unsolicited investment offers, especially if they come from someone you don’t know.

- Use reputable exchanges and wallet providers: Only use reputable exchanges and wallet providers that have a proven track record of security and reliability.

- Monitor your accounts regularly: Regularly monitor your cryptocurrency accounts for any suspicious activity, and report any suspicious transactions to the relevant authorities.

- Keep your software up to date: Keep your computer, phone, and other devices up to date with the latest security patches and software updates.

Protecting Your Investments

While avoiding scams is crucial, protecting your investments is equally important. Here are some tips to help you protect your investments:

- Use cold storage: Consider using cold storage, such as a hardware wallet, to store your cryptocurrency. Cold storage provides an additional layer of security against hacking and theft.

- Diversify your portfolio: Diversify your portfolio by investing in a range of different cryptocurrencies and assets. This can help to reduce your risk and increase your potential returns.

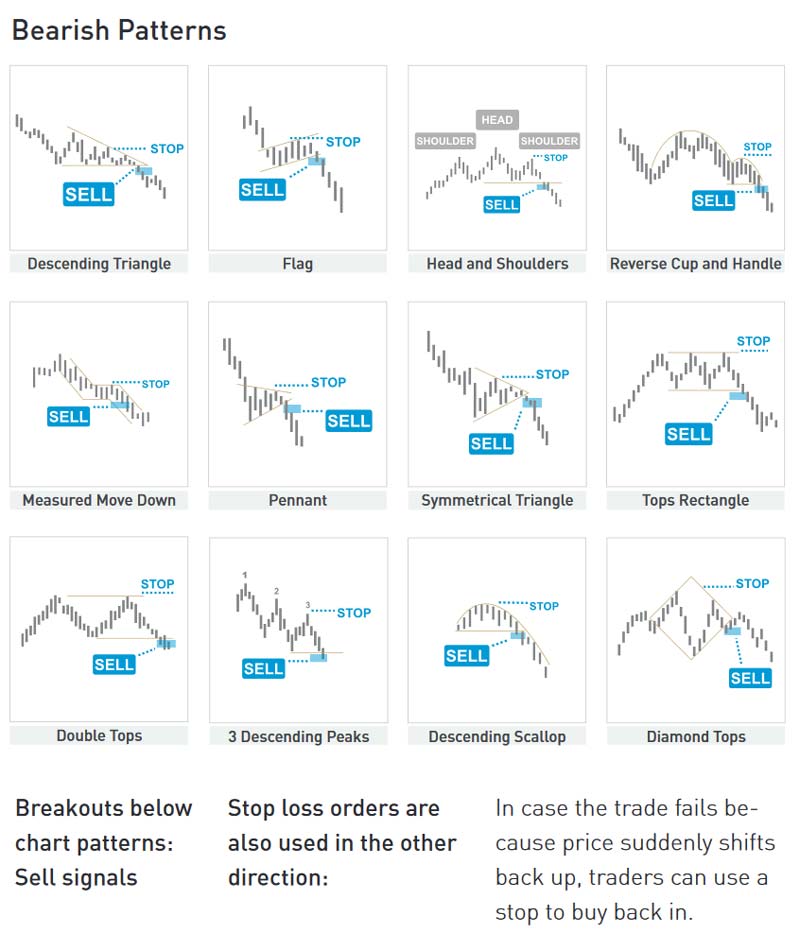

- Set stop-losses: Set stop-losses to limit your losses if the market moves against you.

- Stay informed: Stay informed about market trends, news, and developments that could impact your investments.

- Use a secure internet connection: Use a secure internet connection, such as a VPN, to protect your online activity from hackers and snoops.

Common Cryptocurrency Scam Red Flags

When evaluating a cryptocurrency investment opportunity, watch out for the following red flags:

- Guaranteed returns: If an investment opportunity promises guaranteed returns, it’s likely a scam.

- Unregistered investments: If an investment opportunity is not registered with the relevant regulatory authorities, it’s likely a scam.

- Lack of transparency: If an investment opportunity lacks transparency, such as a clear explanation of the project or a lack of information about the team, it’s likely a scam.

- High-pressure sales tactics: If someone is using high-pressure sales tactics to persuade you to invest, it’s likely a scam.

- Unsolicited offers: If someone approaches you with an unsolicited investment offer, it’s likely a scam.

What to Do If You’ve Been Scammed

If you’ve been scammed, don’t panic. Here are some steps you can take:

- Report the scam: Report the scam to the relevant authorities, such as the Federal Trade Commission (FTC) or your local police department.

- Contact your bank or credit card company: Contact your bank or credit card company to report any suspicious transactions and to request a chargeback.

- Change your passwords: Change your passwords and enable two-factor authentication to prevent further unauthorized access to your accounts.

- Monitor your credit report: Monitor your credit report for any suspicious activity, and consider placing a fraud alert on your credit report.

- Seek professional advice: Seek professional advice from a financial advisor or a lawyer to help you recover your losses and to prevent future scams.

Conclusion

Cryptocurrency scams are a growing concern, but by being aware of the most common scams and taking steps to protect yourself, you can significantly reduce your risk of falling victim. Remember to always research, verify, and be cautious of unsolicited investment offers. By following these tips and staying informed, you can enjoy the benefits of cryptocurrency investing while minimizing your risk of being scammed.

Additional Resources

For more information on cryptocurrency scams and how to protect yourself, visit the following resources:

- Federal Trade Commission (FTC): The FTC provides information on how to spot and avoid cryptocurrency scams.

- Securities and Exchange Commission (SEC): The SEC provides information on how to invest safely in cryptocurrency and how to avoid scams.

- Cryptocurrency exchanges: Many cryptocurrency exchanges, such as Coinbase and Binance, provide information on how to avoid scams and protect your investments.

- Cryptocurrency communities: Joining cryptocurrency communities, such as online forums and social media groups, can provide valuable information and support from other investors.

By staying informed and being vigilant, you can protect yourself from cryptocurrency scams and enjoy the benefits of this exciting and rapidly evolving market.